Housing affordability has emerged as a key issue on this 12 months’s U.S. presidential election. Each Democrat Kamala Harris and Republican Donald Trump have talked about what they’d do to increase the supply of affordable homes and people’s ability to buy them, although their plans have little in frequent.

It’s an essential concern for the general public, too: In a current Pew Research Center survey, 69% of People mentioned they had been “very involved” about the price of housing, up from 61% in April 2023.

However what counts as an “inexpensive” dwelling, and what number of People are struggling to afford a spot to stay? This evaluation tries to reply these questions, utilizing information from U.S. Census Bureau surveys and different sources.What makes a house inexpensive?

One generally used (though also criticized) benchmark for housing affordability is that not more than 30% of family earnings ought to go towards housing prices. Households that spend greater than which can be thought of “cost burdened” by the U.S. Division of Housing and City Improvement.

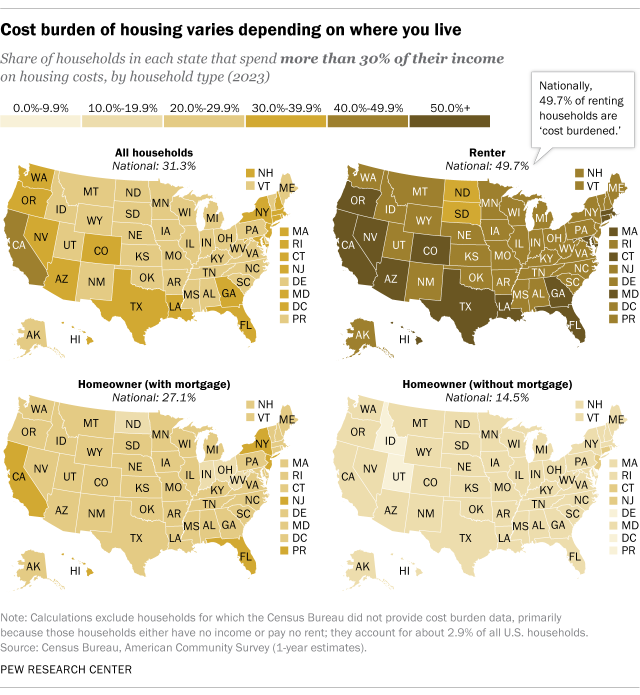

By that normal, 31.3% of American households had been price burdened in 2023, together with 27.1% of households with a mortgage and 49.7% of households that hire, based on 1-year estimates from the Census Bureau’s American Group Survey (ACS). (Many extra folks personal than hire: Within the second quarter of 2024, 65.6% of occupied housing models had been owned whereas 34.4% had been rented, based on the newest estimates from the Census Bureau’s Present Inhabitants Survey/Housing Emptiness Survey.)

We are able to additionally take a look at affordability for renters, particularly, over time utilizing a barely completely different normal: the share who spent 30% or extra of their earnings on gross hire, moderately than the share who spent greater than 30% on complete housing prices. In 2023, about half (51.8%) of renting households paid that a lot in gross hire, ACS estimates present. By comparability, 53.4% of renting households paid that a lot in 2011. The share of renters reaching that threshold hovered round 50% for all the 2011-2023 interval.

How has the housing market modified lately?

The U.S. housing market, as measured by the variety of energetic for-sale properties on native a number of itemizing companies (MLS), shrank dramatically through the COVID-19 pandemic however has since partially rebounded.

On any given day in September 2019, based on Realtor.com, there have been greater than 1.2 million energetic MLS listings. By September 2023, that quantity had fallen 42.7%, to about 702,000. However as of September 2024, there have been about 941,000 energetic listings on a given day, 34.0% greater than a 12 months earlier. (These totals exclude pending listings when that information is obtainable.)

Related patterns are discovered throughout the nation. In September 2024, 78.9% of the 900-plus native markets Realtor.com tracks had fewer energetic listings than they did in September 2019, however 92.2% had extra energetic listings than in September 2023.

In the meantime, dwelling costs proceed to rise. The Federal Housing Finance Agency’s nationwide Home Worth Index, a gauge of how promoting costs for single-family properties have modified over time, was 57.8% increased in July than it was in July 2019. For comparability, the Consumer Price Index – which measures value modifications for a broad vary of client items and companies – rose 22.8% total between September 2019 and September 2024.

Associated:Prices are up in all U.S. metro areas, but some much more than others

How does housing affordability differ geographically?

Like a lot else involving actual property, “location, location, location” performs a key position in how housing price burdens are distributed. That’s very true in California, based on our evaluation of 2023 ACS estimates.

The federal authorities identifies greater than 900 metropolitan and “micropolitan” areas in the US and Puerto Rico, based mostly on the inhabitants of an space’s core metropolis or city. Most of the metropolitan and micropolitan areas with the very best shares of cost-burdened households (i.e., those who spend greater than 30% of their earnings on housing prices) are in California.

Smaller micro- and metropolitan areas, in addition to largely rural states, have a tendency to have decrease shares of cost-burdened households. Wanting on the metro- and micropolitan areas the place the smallest shares of households spend greater than 30% on housing, most have populations smaller than 250,000, and the bulk are positioned in Wisconsin, Alabama or North Carolina.

Some states have particularly excessive shares of households spending greater than 30% of their earnings on housing. For instance, 40.6% of California households meet this threshold – together with greater than half (54.1%) of renters. Roughly related shares of households in Hawaii (38.2%) and Florida (37.2%) additionally spend this a lot on housing prices, based on the 2023 ACS estimates.

On the different finish of the spectrum, a lot smaller shares of households meet the “price burdened” threshold in West Virginia (21.0% of households), North Dakota (22.0%), South Dakota and Iowa (23.6% every).

In each state, a better share of renting households than homeowning ones are price burdened in the case of their housing prices. And homeowning households that carry a mortgage usually tend to be price burdened than those who don’t.

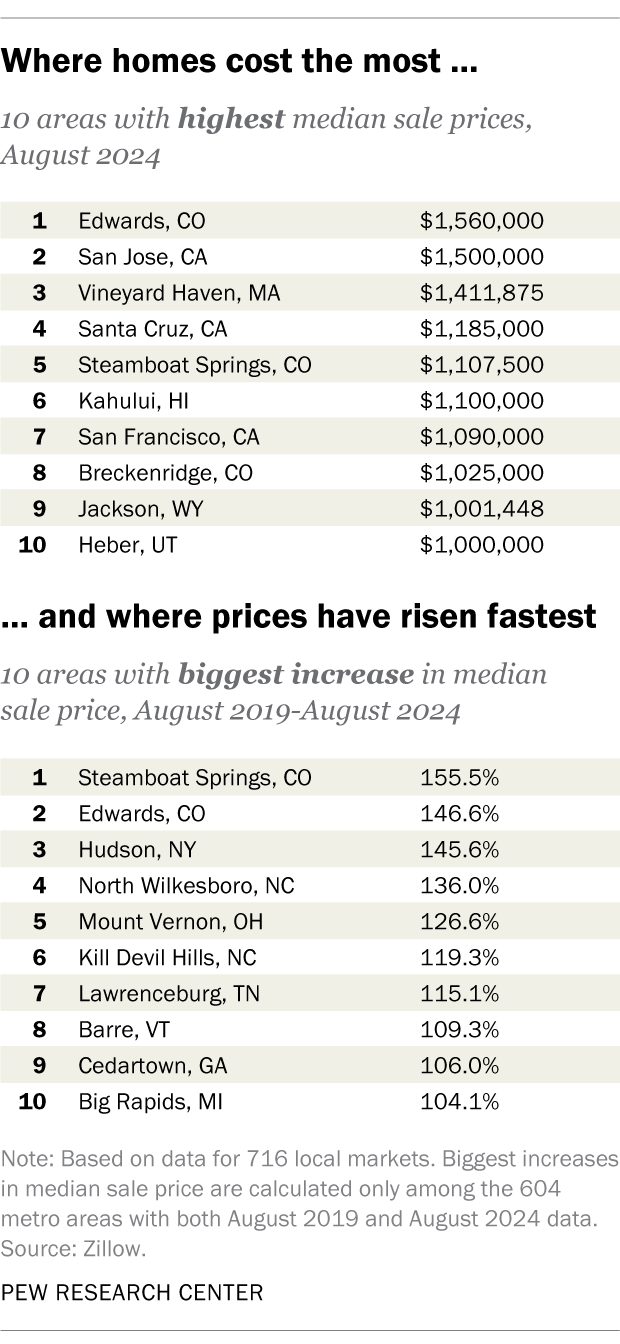

On the similar time, the Federal Housing Finance Company’s state-level home value indices have elevated for each U.S. state and the District of Columbia, by wherever from 22.6% (D.C.) to 82.3% (Maine) between the second quarters of 2019 and 2024. Among the many nation’s 100 largest metro areas, Miami-Miami Seashore-Kendall in Florida had the largest five-year enhance in its home value index between the second quarters of 2019 and 2024: 95.0%.

By way of precise {dollars}, Edwards, Colorado (close to the Vail and Beaver Creek ski areas) tops Zillow’s listing of 716 native markets: The median promoting value there in August 2024 was $1.56 million. However of the 604 localities for which Zillow has 5 years of value information, one other Centennial State ski city was prime of the mountain: Between August 2019 and August 2024, the median promoting value in Steamboat Springs rose 155.5%, from $433,500 to $1,107,500.

What components contribute to housing being unaffordable?

A scarcity of housing affordability is the product of multiple factors intersecting in generally unpredictable methods. Rates of interest, new dwelling building, inhabitants progress, inhabitants shifts, rising dwelling costs and rents, disposable incomes, and native financial situations all have an effect on how simple or tough it may be to discover a dwelling you’ll be able to afford in a spot you wish to stay. Let’s take a more in-depth take a look at just a few of those components.

Rates of interest

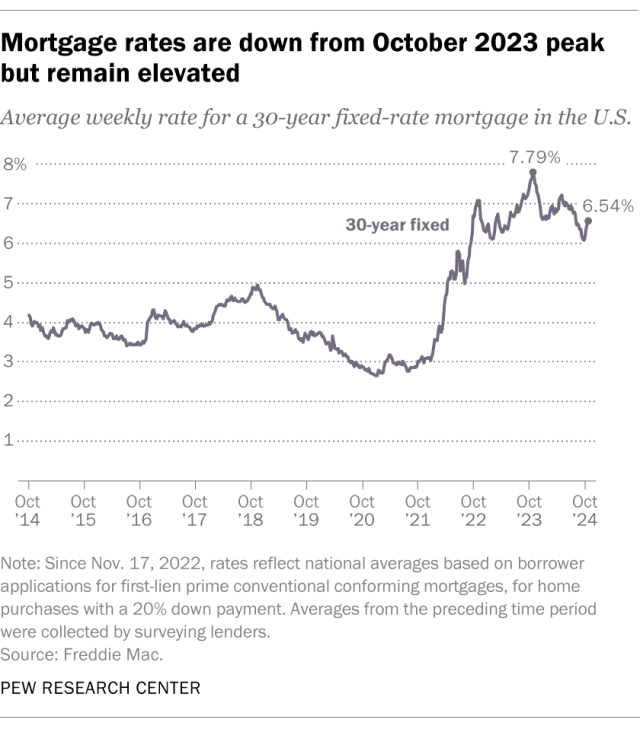

Virtually four-in-ten households (39.3%), or 51.6 million, carry mortgages on their properties, based on 2023 ACS estimates. Quickly after the COVID-19 pandemic started, the common rate of interest on a 30-year fastened mortgage fell dramatically – from 3.72% firstly of 2020 to as little as 2.65% by the beginning of 2021, based on data from Freddie Mac. That prompted tens of millions of house owners to refinance their mortgages, locking in low charges and decreasing their month-to-month funds. (A similar refinancing wave adopted the collapse of the 2000s housing bubble.)

Since then, the common 30-year charge has soared as excessive as 7.79% (in late October 2023) and fallen to, as of lateOctober 2024, 6.54% – roughly monitoring investor expectations on inflation and the path of Federal Reserve interest-rate policy.

Nonetheless, based on a recent analysis by Federal Housing Finance Agency economists, most householders with fixed-rate mortgages are sitting on rates of interest effectively beneath what they’d get in the event that they took out a brand new mortgage at the moment – limiting their skill, or willingness, to place their present properties in the marketplace. In that working paper, the economists estimate that this “lock-in” impact led to 1.33 million fewer dwelling gross sales between the second quarter of 2022 and the top of 2023.

New dwelling building

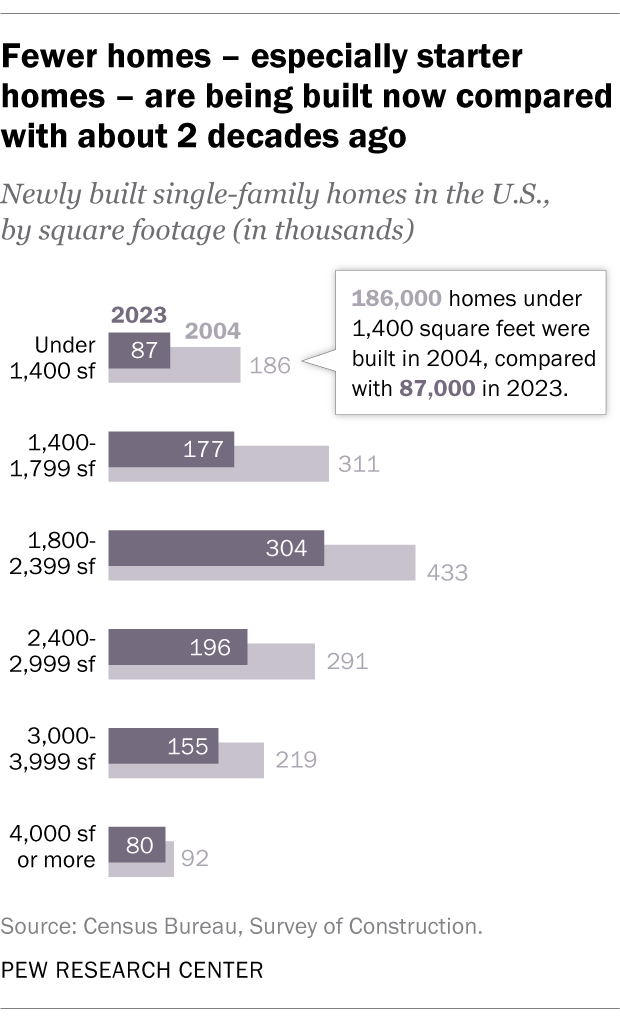

One other solution to enhance the stock of properties on the market is to construct extra of them. However the homebuilding business took a deep dive through the Nice Recession – falling from 2.07 million privately owned housing unit “begins” in 2005 to 554,000 in 2009 – and nonetheless has a solution to go earlier than returning to pre-crisis ranges. In September 2024, housing begins had been working at a seasonally adjusted annual charge of 1.35 million, according to the Census Bureau’s Survey of Construction.

The decline has been particularly pronounced in entry-level single-family homes, outlined as these smaller than 1,400 sq. toes. The height 12 months this century for brand new properties of that measurement was 2004, when 186,000 had been constructed (12.1% of all single-family properties constructed that 12 months). In 2023, nonetheless, solely 87,000 new single-family properties (8.7%) had been below 1,400 sq. toes, according to the Census Bureau.

In the meantime, 23.5% of recent single-family properties in 2023 had been 3,000 sq. toes or bigger, in contrast with 20.3% in 2004.

Multifamily housing, comparable to condo and apartment buildings, might supply some reduction. Popping out of the Nice Recession, buildings with 5 or extra models had been accomplished at a steadily rising tempo till rising considerably in 2023, according to the Census Bureau’s Survey of Construction. That 12 months, 438,300 such privately owned housing buildings had been accomplished, greater than in any 12 months since 1987. And as of September 2024, completions of buildings with 5 or extra models had been working at a seasonally adjusted annual charge of 671,000.