Chinatown in Lima, Perú. China has turn out to be an essential buying and selling companion to the South American nation. (Photograph by Alex Particular person on Unsplash)

China,

Southern Cone,

United States

April 8, 2023

By

Alfredo Eladio Moreno

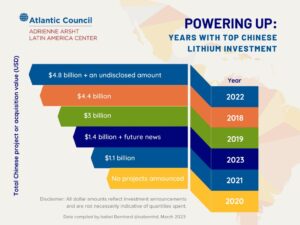

NEW YORK — Yr-to-date, Chinese language investments in Latin American lithium — as measured by the worth tag of initiatives and acquisition worth — have surpassed funding ranges in 2021, in line with the Atlantic Council’s Latin America Middle. The identical information present that funding ranges dropped from 2018 by means of 2021, however then peaked in 2022 at over $4.8 billion USD.

1 / 4 into 2023, Chinese language investments in lithium have surpassed ranges from 2020 and 2021. (Twitter / Latin America Middle, Atlantic Council)

Bilateral relations between China-Latin America ballooned on the flip of the century. Commerce between China and Latin America grew at an annual charge of 31% from 2000 to 2009 and thru the Nice Recession. In financial worth, the amount of commerce in items elevated from $14.6 billion USD in 2001 to $315 billion in 2020, in line with fDi intelligence.

The figures replicate what’s referred to as the “commodity increase,” when Latin American provide of commodities — foodstuffs and minerals like copper — met Chinese language demand for them. Although the erstwhile commodity increase of 2003-2012 is over, China’s funding developments in lithium point out a vote of confidence in lithium’s potential, Latin America’s capacity to produce it, and its personal clout within the area.

Taking Inventory of the Take-Off

The duvet of the Economist’s Nov. 14, 2009 situation featured a curious picture: Christ the Redeemer jet-propelled off the bottom and into the sky, taking off to new heights. The title? “Brazil takes off.”

Nov. 14, 2009 cowl of The Economist

The weekly journal was in awe. A rustic “whose infinite capability to squander its apparent potential [and] was as legendary as its expertise for soccer and carnivals” had carried out the unimaginable: It had turn out to be an industrial liberal democracy, “whipped into form” by privatization and openness — a “smart set of financial insurance policies,” mentioned the journal.

But when Brazil was taking off, then it was merely the bellwether: on its tail was a flock of Latin American nations additionally propelled by the commodity increase.

Outcomes have been nothing in need of stellar. Poverty decreased from about 27% to 12%, and inequality decreased by 11% between 2000 and 2014, reported the IMF. Though many nations within the area skilled a lower in poverty, these advantages fell unequally throughout the area. South American nations, particularly Ecuador, Bolivia, Argentina, Colombia, Peru and Brazil, skilled drastically bigger drops in poverty than Central American or Caribbean nations. Nicaragua’s 15% discount in poverty pales compared to Ecuador’s 30% or Bolivia’s 25%.

What differentiated the South American nations from their neighbors was that they benefited from extra favorable phrases of commerce, thus they have been exporting considerably greater than they have been importing. Consequently, commodity sectors in these nations burgeoned, and opened up formal jobs for its inhabitants. Although the development is imperfect, because the phrases of commerce skewed in the direction of larger exports, so the good points in poverty discount have been larger.

Latin American nations took a blended strategy to the way in which they reaped the advantages of the commodity increase. Whereas free market forces opened up employment to the labor pressure, leftist governments using the Pink Wave additionally took the chance to institute social insurance policies that put money within the palms of its poorest. These insurance policies different, too. Bolivia and Peru started the non-contributory pension applications Renta Dignidad and Pensión 65, respectively. In Brazil, the conditional cash-transfer program Bolsa Familia gives month-to-month money help to households on the situation they meet necessities associated to the well being and training of their kids.

From 2003-2012, the spigot of cash flowing into the area was on excessive, and China was the supply. Commodity costs and commerce revenues are unstable, nevertheless, thus extra susceptible to international macroeconomic elements. For instance, when oil costs started to droop in 2013, the Venezuelan financial system had no different recourse however to witness a catastrophe: The financial system shrank by roughly three-quarters between 2014 and 2021. As an entire, Latin American nations needed to grapple with budgetary pressures as revenues slowed. Even so, a transparent relationship had been established: China imprinted itself on Latin America.

Shifting Superpower Relations

Spectacular ties have been solid between Latin America and China in the course of the commodity increase. By 2020, the worth of commerce in items between China and Latin America elevated 21-fold.

Because of this, China unseated the European Union because the area’s second largest buying and selling companion. Whereas the US nonetheless sits on the high of Latin America’s record of buying and selling companions, China has turn out to be South America’s most essential export market.

Gabriel Cohen, PhD candidate at Pompeu Fabra College in Barcelona, sees China’s ascendancy in Latin America as a diversification within the choices of superpowers with which to barter.

He advised LAND that the US’ relationship with Latin America immediately is an extension of Chilly Warfare coverage, when there was no credible various superpower with which to barter. Because the commodity increase, that’s modified.

An rising entrance in Chinese language-Latin American relations has been growth financing. “What we see is to a point a flip to China as a result of China would offer financing the place conventional multilateral establishments — whether or not or not it’s the IMF, World Financial institution, et cetera — could be extra hesitant,” mentioned Cohen. The demand for growth financing is perennial, however the provide — from multilateral establishments or the non-public sector — could be finicky, since they’re extra risk-averse.

“China has turn out to be type of a lender of final resort. There are political components too. It has no drawback benefiting from the truth that debt strengthens its hand.”

These political components — particularly, Sino-American rivalry — have strengthened because of the commodity increase, however have additionally benefited from U.S. coverage since then.

Altering U.S. Coverage

In 2013, Roberta Jacobson, Assistant Secretary of State for Western Hemisphere Affairs, mentioned that the U.S. does “not in any method see China as a risk.” Chinese language state information group Xinhua then cited Jacobson’s remark on the Sixth China-US Sub-Dialogue on Latin America, saying that the U.S. sees extra potential in partnerships with China within the area than adversity.

However the stakes modified in the course of the Trump administration, when then-president Trump advocated, at the least symbolically, for the retreat of the US on the worldwide entrance, and a extra inward-focused coverage. The implications of such a transfer are a matter of politics. Some materials advantages would possibly level to a solution, nevertheless.

For instance, within the wake of the Covid-19 pandemic, China offered Latin American nations with its vaccine, what’s been known as Covid diplomacy and what analysts say is “an effort to enhance its picture and curry favor with regional governments,” in line with the Council on Foreign Relations. A rustic whose chief on the helm questioned Covid, might need coincidentally tarnished the popularity of the U.S. in Latin America, or at the least weakened reliability.

Moreover, in some situations, China’s Covid vaccines didn’t come with out strings hooked up.

Honduras and Paraguay, alleged that they confronted strain to renounce their recognition of Taiwan in change for doses. (Honduras has since renounced its recognition of Taiwan; Paraguay has not.)

If the symbolic retreat of the U.S. in the course of the Trump administration strengthened China’s hand, then the Biden administration’s response since then has been a assured and “play-it-cool” rapprochement. At a gathering with Argentine president Alberto Fernández, Biden erred away from two matters: China and lithium.

“The US-Argentina relationship is more and more characterised by mutual curiosity in creating lithium deposits and in defining China’s function in Argentina, within the latter case each within the space of China’s rising lithium investments and in different areas,” mentioned Isabel Bernhard from the Atlantic Council.

The “play-it-cool” strategy has been counterbalanced by one large transfer, nevertheless: the Americas Partnership for Economic Prosperity, a multi-sector and region-wide cooperative settlement that features 11 nations accounting for 90% of the western hemisphere’s GDP. With out particulars hashed out but, the facility of the partnership stays symbolic.

All issues thought of, contracts with China stay seductive for his or her simple no-strings-attached nature, what Overseas Coverage known as a “difficult sport.”

Lithium: Balls and Courts, Commodities and Markets

Lately, Lithium has arisen as a type of wunderkind. Some key expectations have been positioned on the white steel, notably its significance to lithium ion batteries, or LIBs.

Power consultants and worldwide enterprise consultants alike agree on the growing significance of the highly-reactive white steel. Demand hinges on LIBs, that are alluring for his or her superior capability to retailer electrical power. LIBs can retailer as much as 10% extra power than conventional lead-acid batteries, mentioned the Inter-American Growth Financial institution.

The demand for LIBs has elevated since 2010. Demand is projected to extend almost 1,700% (as measured in gigawatt-hours) by 2030. Moreover, LIBs are important parts of electrical autos, which have experienced a boom lately.

The attract of LIBs in fueling the clean-energy transition are evident (despite the fact that lithium extraction may cause damage to the environment), and Latin America’s function in an rising lithium commodity increase are apparent. Argentina, Bolivia and Chile — nations collectively referred to as the world’s “Lithium Triangle” — make large contributions to the world’s provide of uncooked lithium. The Lithium Triangle and Peru include 67% of the world’s recognized reserves.

Total, they produce half of worldwide provide. The business was projected to succeed in a worth of $7.7 billion by this 12 months. It goes with out saying that lithium is a cornerstone of those nations’ commodity sectors.

Not least, extracting lithium following a mannequin of export-led growth is seductive. Nevertheless it may maintain Latin America caught in a “growth loop” the place the area advantages from the excessive of a increase, after which has to take care of the hangover of bust, Cohen advised LAND. “It goes again to the age-old query of the place do you spend your cash while you get it?” he mentioned.

A useful answer is likely to be to create value-added merchandise from lithium within the nations from which they’re extracted, an answer that German Chancellor Olaf Scholz prompt in his go to to Argentina, Chile and Brazil this previous January. The proposition would require the creation of sufficient infrastructure in proposed mining websites.

An analogous strategy was introduced by the Biden administration in February 2022. Often known as the “Made in America Provide Chain,” the investments would prospect lithium mining websites in California and develop them to create home markets for the white steel. Two months later Mexico made a similar transfer, its legislature nationalizing lithium reserves within the nation, although the prospects of Mexico’s competitiveness within the rising lithium market is up for debate.

Finally, greater than lithium provide will decide competitiveness. With out growth financing or favorable loans from in a position nations for the creation of important infrastructure so as to add worth to lithium merchandise, lithium extraction and value-added manufacturing is likely to be troublesome. Not all economies are created equal, and never all states can afford to manipulate the identical method as main superpowers.

Prices and Advantages of Symbolic Gestures

Equally, the worth for recognizing China is just too excessive, Cohen advised LAND. “How a lot can you continue to keep away from China when all of your neighbors are working with China?”

On this respect, Honduras’ renunciation of recognition for Taiwan is greater than a marketing campaign promise made by President Xiomara Castro fulfilled, it’s a symbolic gesture indicating to China that Honduras is open for enterprise. With the US’ superpower monopoly declining in some respects, Latin American nations now must weigh the prices and advantages of gesturing in the direction of China, and different superpowers broadly.

“The actual fact of the matter is that, immediately, China is indispensable to the area,” Cohen mentioned.

The rising lithium market represents simply one other variable that Latin American nations must keep in mind in making gestures and enterprise offers with superpowers.

About

Alfredo Eladio Moreno

Fredo is a journalist and photographer from his native Houston, Texas. He has reported since 2020 on Mexican politics and immigration coverage in the US, and particularly on Nicaragua and the Ortega-Murillo regime. He’s a graduate pupil of Journalism and Latin American and Caribbean Research at New York College, the place he’s Editor-in-Chief of the Latin America Information Dispatch.